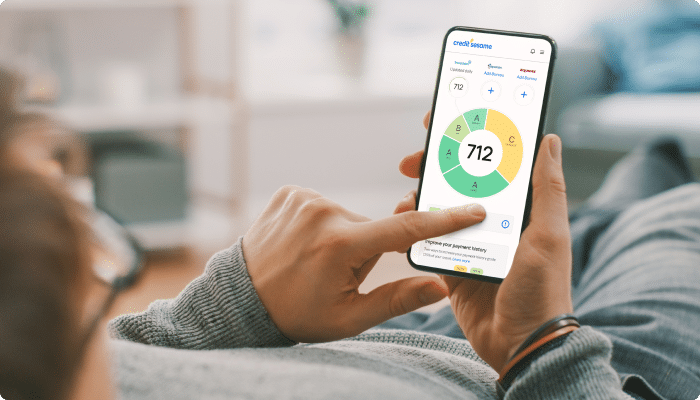

In the complex and often confusing world of personal finance, a single three-digit number holds a remarkable amount of power over your financial life. That number is your credit score. While it may seem like a simple, abstract figure, your credit score is far more than just a number; it’s a reflection of your financial health, a predictive tool that tells lenders, landlords, and even insurance companies how reliable you are as a borrower. A high score is a key that unlocks a world of financial opportunities, while a low score can create a series of roadblocks that make it difficult and expensive to borrow money, rent a home, or even get a job.

This comprehensive guide will demystify the credit score, explaining its purpose, the factors that influence it, and providing a step-by-step strategy for building and maintaining an excellent score. We will go beyond a simple statement of the obvious, providing a detailed breakdown of the anatomy of your score, the tangible benefits of a high score, and a practical action plan that every individual can use to take control of their financial future.

The Three-Digit Story

Before you can build a better score, you must first understand how it is calculated. Your credit score is a complex algorithm that is based on your credit report, a detailed history of your borrowing and repayment habits.

- A. What Is It and Who Calculates It? A credit score is a numerical prediction of a borrower’s creditworthiness. It is a tool that lenders use to assess the risk of lending money to you. The two main credit scoring models are the FICO Score and the VantageScore, and the data is provided by the three major credit bureaus: Experian, Equifax, and TransUnion.

- B. The Five Key Factors: The credit score is a weighted average of five key factors. Understanding these factors is the most important step in building a better score.

- Payment History (35%): This is the most important factor in your credit score. It’s a record of whether you have paid your bills on time. A single missed payment can have a significant and lasting impact on your score.

- Credit Utilization (30%): This is the ratio of the amount of credit you are using compared to your total credit limit. A low credit utilization ratio (typically below 30%, and ideally below 10%) indicates that you are a responsible borrower and are not overextended.

- Length of Credit History (15%): This is the age of your credit accounts. A longer credit history indicates that you have a consistent track record of borrowing and repayment, which makes you a more reliable borrower.

- Credit Mix (10%): This is the mix of credit accounts you have, such as credit cards, mortgages, and auto loans. A good credit mix indicates that you can responsibly manage different types of credit.

- New Credit (10%): This is the number of new credit accounts you have opened recently. A large number of new accounts in a short period can signal that you are a high-risk borrower.

- C. The Difference Between a Good and Excellent Score: Your credit score is not a pass/fail grade. It is a spectrum that tells lenders how much of a risk you are.

- Poor (300-579): This score indicates that you are a high-risk borrower.

- Fair (580-669): This score indicates that you are an average borrower. You may be able to get a loan, but with a higher interest rate.

- Good (670-739): This score indicates that you are a reliable borrower and can get a loan with a favorable interest rate.

- Very Good (740-799): This score indicates that you are a great borrower and can get a loan with a very low interest rate.

- Exceptional (800+): This score indicates that you are an excellent borrower and can get the lowest interest rates and the most favorable terms.

The Power of a High Score

A high credit score is not a goal in itself; it’s a powerful tool that can unlock a world of financial opportunities and save you a significant amount of money over the life of your loans.

- A. Lower Interest Rates on Loans: This is the most obvious and powerful benefit. A high credit score can save you a significant amount of money on a mortgage, a car loan, or a personal loan. For example, a 1% difference in the interest rate on a 30-year, $300,000 mortgage can save you tens of thousands of dollars.

- B. Easier Approval for Loans and Credit Cards: A good credit score makes you a more attractive borrower. Lenders will be more likely to approve your application and will do so with a faster, easier process. This is a massive time-saver and a source of peace of mind.

- C. Lower Insurance Premiums: This is a surprising benefit. Many insurance companies use a credit-based insurance score to determine your insurance premiums. A high credit score can lead to a lower premium on your car insurance, your home insurance, and your life insurance.

- D. Better Rental Opportunities: Landlords often check the credit scores of potential tenants. A good credit score can help you get approved for a rental home, and it can also help you avoid having to pay a security deposit.

- E. Avoiding Security Deposits: Many utility companies, such as electric, gas, and internet providers, may waive a security deposit for a borrower with a good credit score. This is a small but powerful benefit that can save you a significant amount of money.

- F. The “Credit is Power” Principle: A good credit score gives you leverage in a negotiation. It tells a lender that you are a reliable borrower and that they have to compete for your business. This can help you get a better rate on a loan, a better deal on a car, and a more favorable repayment plan.

Building and Maintaining a Great Score

Building a great credit score is a long-term process, but it is a process that you can take control of today. By following a step-by-step guide, you can begin to build a credit score that will serve you for a lifetime.

- A. Get a Copy of Your Credit Report: The first and most important step is to get a free copy of your credit report from all three major credit bureaus. Review your report for any errors and dispute them immediately.

- B. Pay Bills On Time, Every Time: This is the most important factor in your credit score. You must pay all of your bills on time, including your credit cards, your loans, and your utility bills. A single missed payment can have a significant and lasting impact on your score.

- C. Reduce Your Credit Utilization: This is the quickest way to boost your score. You should aim to keep your credit utilization ratio below 30%, and ideally below 10%. You can do this by paying down your credit card balances or by asking for a credit limit increase.

- D. Keep Old Accounts Open: The length of your credit history is an important factor in your credit score. You should keep your old credit accounts open, even if you are not using them. Closing an old account can shorten your credit history and can have a negative impact on your score.

- E. Apply for New Credit Sparingly: A hard inquiry on your credit report can have a small, temporary negative impact on your score. You should only apply for new credit when you need it, and you should not apply for multiple credit cards or loans in a short period.

- F. Become an Authorized User: If you are a young person with a limited credit history, you can ask a parent or a guardian with a good credit score to add you as an authorized user on one of their credit cards. This is a great way to build a credit score without having to take on any debt.

The Future of Credit Scoring

The world of credit scoring is constantly evolving, with new technologies and new ideas that are changing how we measure creditworthiness.

- A. AI and Alternative Data: The traditional credit score is a great metric, but it is not a perfect one. In the future, AI and machine learning will be used to analyze a wider range of data to create a more holistic credit score. This could include rent payments, utility bills, and other financial data.

- B. The Shift to Financial Wellness: The trend is moving away from just a single credit score and toward a more comprehensive view of a person’s financial health. New tools are emerging that can provide a holistic picture of your financial situation, including your savings, your investments, and your debt.

- C. Personalized Credit Management Tools: In the future, AI will be used to provide you with personalized advice on how to improve your credit score. These tools will analyze your financial data and provide you with a step-by-step plan for building a better score.

Conclusion

Your credit score is not a goal in itself; it’s a byproduct of a healthy financial life. By understanding it and taking control of it, you are not just building a better score; you are building a foundation for a future of financial stability and freedom. A good credit score is a powerful tool that can save you a significant amount of money, provide you with more opportunities, and give you a new sense of peace of mind.

The journey to a great credit score is a long-term process, but it is a process that you can begin today. By paying your bills on time, reducing your credit utilization, and being a smart, informed borrower, you can build a credit score that will serve you for a lifetime.